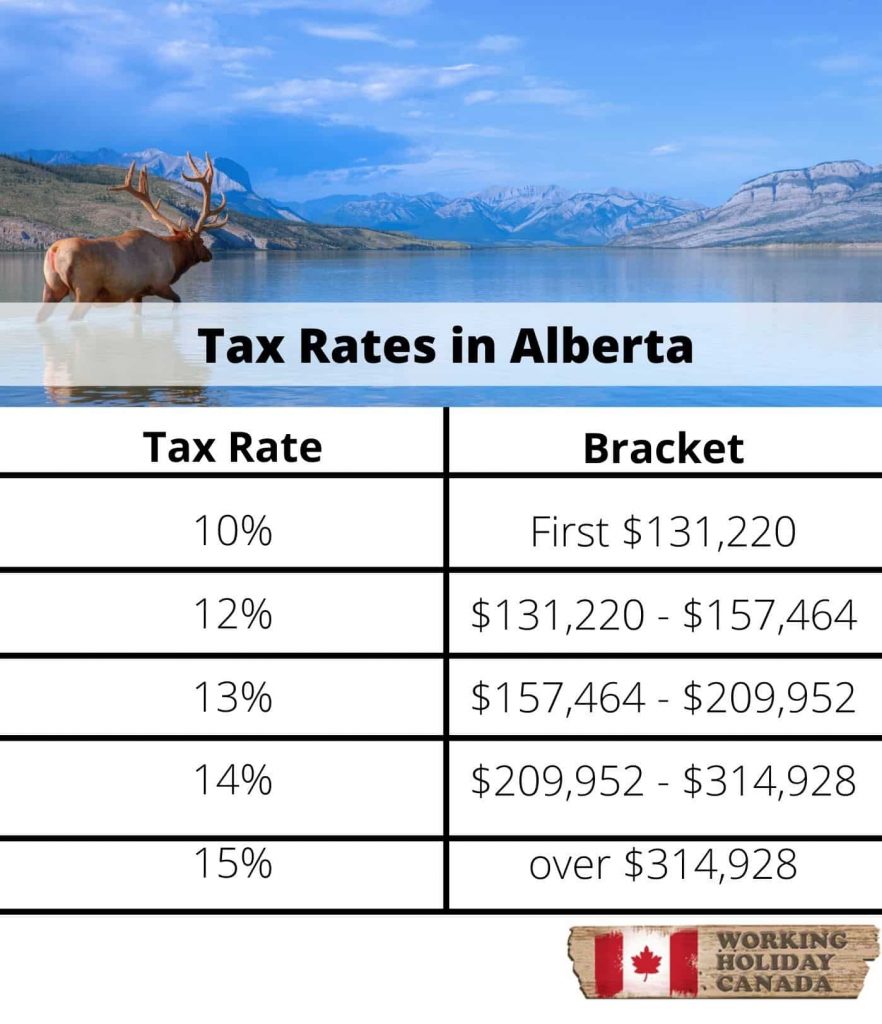

Income Tax Table 2025 Canada. Your tax bracket is based on “taxable income,” which is your gross income from all sources, minus any tax deductions you. Discover the canada tax tables for 2025, including tax rates and income thresholds.

Filed your income tax with the canada revenue agency (cra) the previous year; The amounts assume that all income is interest, ordinary income (such as salary) and/or taxable capital gains, and only the basic personal tax credit.

2025 Tax Brackets Canada Pdf Kaila Mariele, Filed your income tax with the canada revenue agency (cra) the previous year;

Tax Calculator Canada 2025 Image to u, Federal and provincial/territorial income tax rates and brackets for 2025 current as of september 30, 2025

2025 Tax Brackets Canada With Dependents Dannye Chiarra, Federal and provincial/territorial income tax rates and brackets for 2025 current as of september 30, 2025

Canada Federal Tax Brackets 2025 Cele Cinderella, Use t4032, payroll deductions tables to calculate the federal, provincial and territorial income tax deductions, the employment insurance premiums, and the canada pension plan.

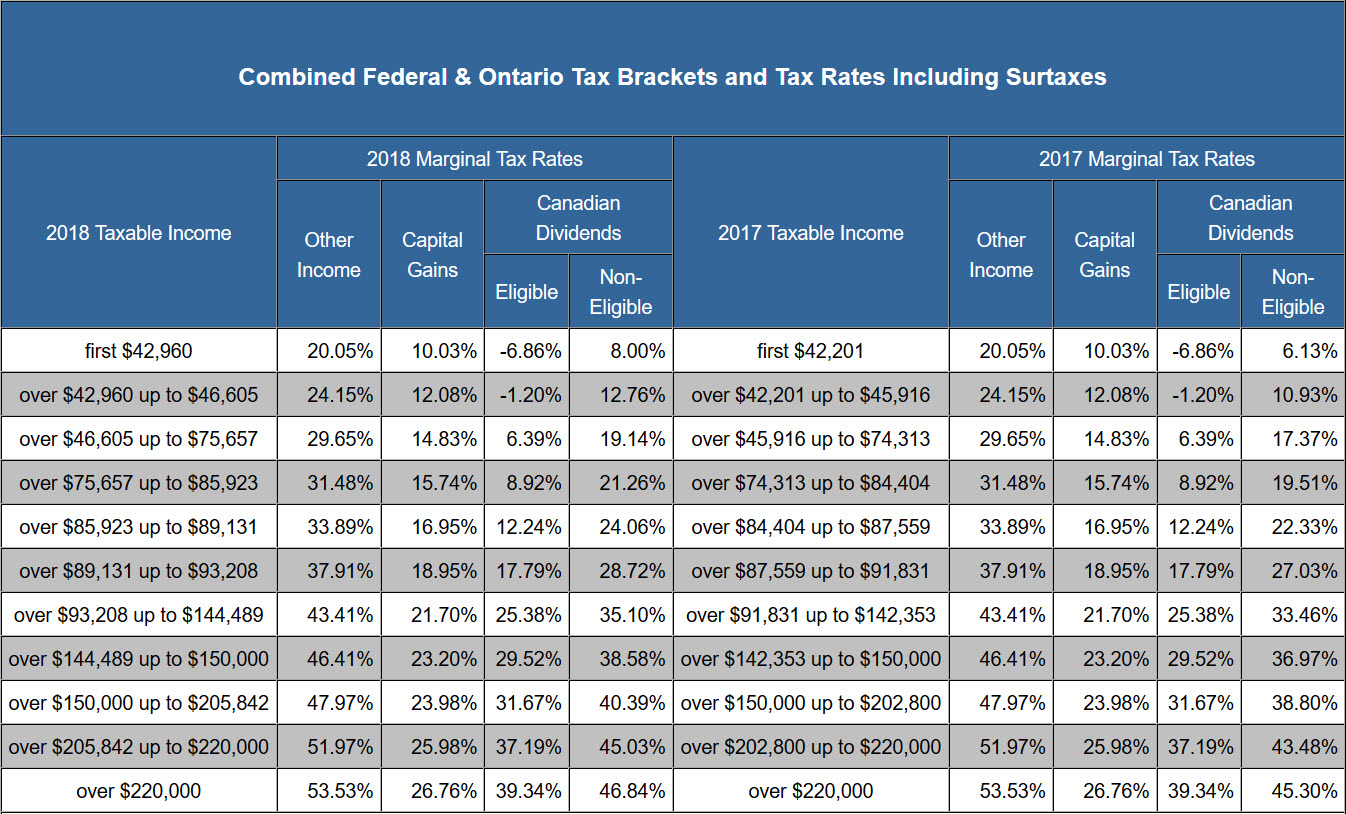

Canada Tax Tables 2025 Tax Rates and Thresholds in Canada, Calculate your combined federal and provincial tax bill in each province and territory.

2025 Tax Brackets Canada Mela Stormi, Use t4032, payroll deductions tables to calculate the federal, provincial and territorial income tax deductions, the employment insurance premiums, and the canada pension plan.

2025 Tax Tables Canada Single Carie Corrine, 61 rows here we’ve collected everything you need to know about this year’s income tax rates.

Canada Tax Brackets For 2025 Know Ontario Tax Brackets Rates, Your tax bracket is based on “taxable income,” which is your gross income from all sources, minus any tax deductions you.